If you’re still relying on traditional bank wires, you may have experienced how expensive and slow the process can be. But now, receiving money from abroad has been made easier. Whether you’re a freelancer working with international clients, supporting family overseas, or running a business that relies on global transactions, the right app can make all the difference.

With technology bridging gaps, you can now get dollars directly into your account, from the convenience of your smartphone. In this article, we’ll explore five of the best apps to receive dollars from abroad, discussing what sets each apart and what to consider before choosing one.

Choosing the Right Money Transfer App

Before we get into the specifics, it’s important to know what to look for when choosing an app for receiving dollars:

- Speed: How fast can you receive the money? Some apps offer near-instant transfers, while others might take a day or two.

- Fees and Exchange Rates: Every app has its fee structure. Some charge a flat fee, others a percentage of the transferred amount, and many offer competitive exchange rates. Always compare before committing.

- Ease of Use: A clean, intuitive interface can greatly reduce the stress of international transfers.

- Availability: Check that the app operates in both the sender’s and receiver’s countries. Coverage can vary, so check if it supports your region.

- Security: Look for strong security measures like encryption, two-factor authentication, and positive customer reviews.

ADVERTISEMENT

Considering these criteria, here are five standout apps to consider when you need to receive dollars from abroad.

1. Remitly

Remitly is highly regarded for its user-friendly design and efficient service. It was built for international transfers, making it a reliable option for quickly and securely receiving dollars.

Key Features:

- Speed and Reliability: Remitly offers fast transfer options, so depending on your location and chosen delivery method, you can often have the money in your account within minutes.

- Transparent Fees: The app is known for a clear fee structure, so you won’t be surprised by hidden costs. You are provided with the total cost and delivery time before you send your transfer.

- User-Centric Experience: With a simple sign-up process and intuitive navigation, even first-time users easily manage their transfers.

For many users, Remitly stands out because it combines speed with low costs, ensuring that more of the money you receive actually makes it to your pocket.

Where to Download: Apple Store and Google Playstore.

2. Wise (Formerly Known as TransferWise)

Wise is popular for its transparency and competitive exchange rates. Instead of adding hefty margins to the conversion rate, Wise uses the real mid-market rate, meaning you get exactly what’s on the global market.

Key Features:

- Honest Pricing: With low, upfront fees and an exchange rate that mirrors the market, Wise ensures you know exactly what you’re paying for each transfer.

- Versatile for Business and Personal Use: Wise accommodates a wide range of transfer needs, whether you’re receiving payments from a client or a family member.

- Smooth Interface: The app is designed to be straightforward, allowing users to track their money at every step.

- Multi-Currency Accounts: Wise lets you hold and manage funds in different currencies, which can be very helpful if you receive money in multiple currencies over time.

For those who value clear pricing and reliable service, Wise offers a solid solution for receiving international dollars without any unexpected charges.

Where to download: Apple Store and Google Playstore.

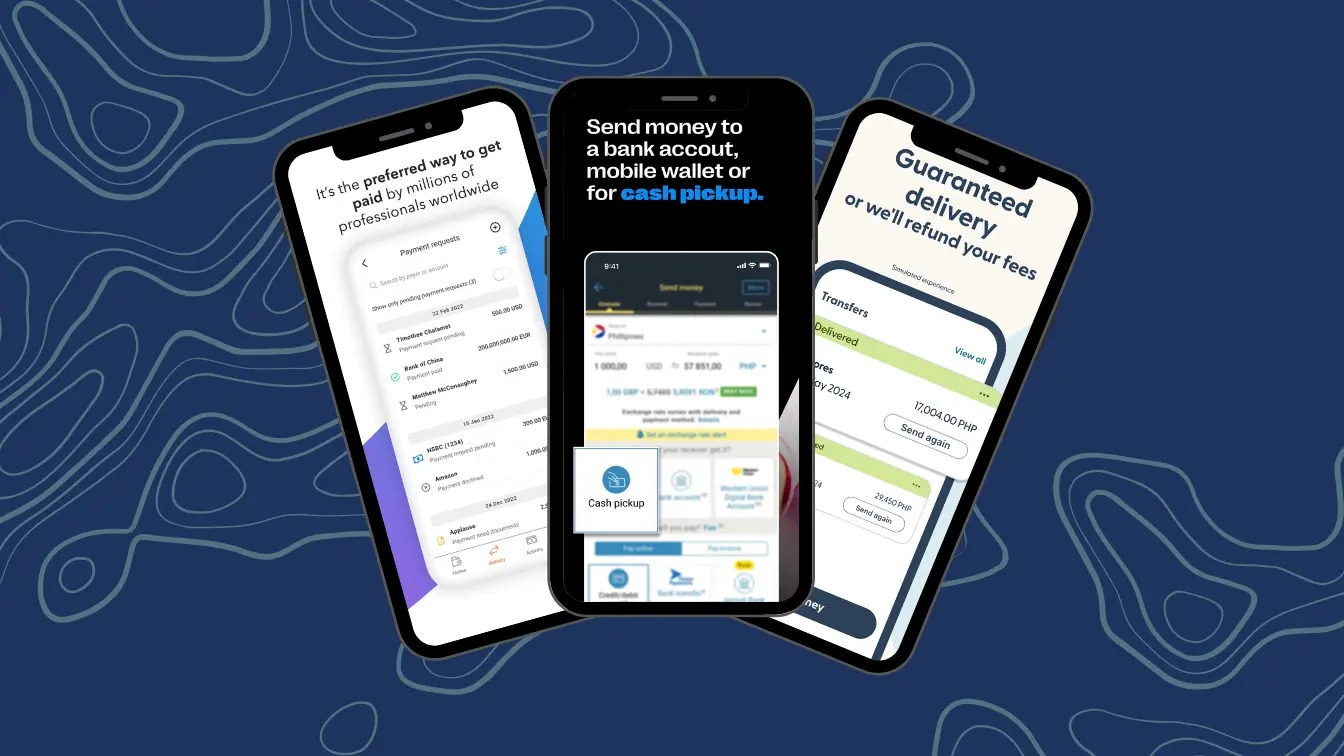

3. WorldRemit

WorldRemit is another popular international money transfer option known for its versatility. The app allows recipients to receive their funds in various ways, such as bank deposits, mobile wallet credit, or cash pickup.

Key Features:

- Multiple Delivery Options: You can choose how you receive your money depending on your needs. This flexibility is particularly useful if you don’t have a bank account or prefer to collect cash in person.

- Widespread Coverage: WorldRemit operates in numerous countries, making it a great option if you or the sender live in a region with limited banking services.

- Simple Process: WorldRemit makes setting up a transfer easy, thanks to its clear instructions and support options for users who need extra help.

Where to download: Apple Store and Google Playstore.

4. Western Union

Western Union is a name that has been trusted for decades in the world of international money transfers. Even as digital solutions have evolved, Western Union has managed to maintain its reputation for reliability.

Key Features:

- Global Network: With thousands of agent locations worldwide, Western Union offers various ways to receive your money, such as bank deposit or cash pickup at a local agent.

- Legacy Trust: As one of the industry’s oldest players, Western Union offers a level of trust and familiarity that many users appreciate.

- User-Friendly App: Their mobile app is designed with simplicity in mind, making it easy to track your transfers, check rates, and manage your account on the go.

- Service Variety: In addition to personal transfers, Western Union also caters to business needs, offering tailored solutions for international companies.

If you’re looking for an app backed by decades of experience and a solid network, Western Union is a dependable choice for receiving dollars from abroad.

Where to Download: Apple Store and Google Playstore.

5. Payoneer

For freelancers, online sellers, and businesses, Payoneer has become a preferred platform for receiving international payments. Its digital accounts mimic many features of traditional bank accounts, providing a modern solution for global financial needs.

Key Features:

- Digital Bank Account: Once you set up your account, it functions much like a local bank account. You can withdraw funds, transfer money locally, and even use a Payoneer card where available.

- Tailored for Business: Payoneer is particularly popular among international businesses. It’s designed to handle frequent, regular transactions, making it a favourite among professionals.

Payoneer’s comprehensive features make it a strong option for managing global payments for anyone who regularly receives dollars as a part of their work or business.

Where to Download: Apple Store and Google Playstore.

According to Monito (a site that Compares International Money Transfer Services and tracks Exchange Rates).

- Remitly is the cheapest overall option for sending money to Nigeria. It’s also a great option for US, EU, and UAE transfers.

- Western Union is a good option if you receive money from senders in the USA, the UK, or Germany.

- WorldRemit is not always the cheapest but also the best app for sending money for cash pickups.

With the right app, what used to be a cumbersome process is now a matter of a few taps on your phone. Whichever app you choose from our top five, you’ll be joining millions of people worldwide who are taking control of their finances more streamlined and efficiently.